- #Does quicken mint have expense accounts how to#

- #Does quicken mint have expense accounts software#

- #Does quicken mint have expense accounts free#

Doesn’t deduct from historical withdrawals.Doesn’t work properly on the smart phone app.Can’t account for a cash expense larger than your last single withdrawal.Obfuscates how much your ATM withdrawal actually was.Forces an expense/expenses to a specific withdrawal.Can’t account for spending the sum total of multiple withdrawals.

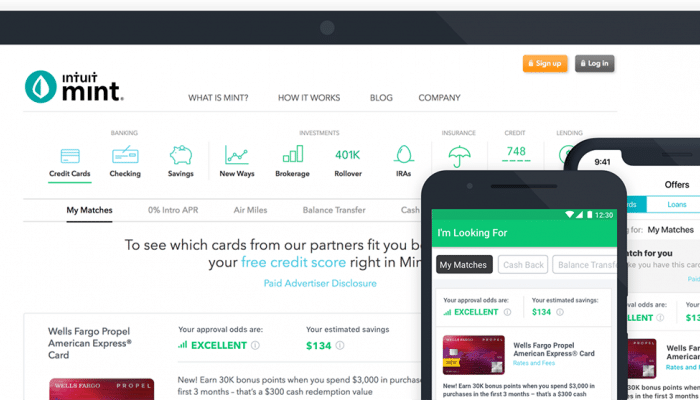

Mint’s solutions, splitting withdrawals and auto-deducting from your last withdrawal, are not intuitive, prone to bugs and errors, or do not work at all, leaving many users in the dark about where their money is really going, or worse, seeing more expenses than they actually incur.

When users then want to categorize how they spend the cash, many either end up double booking or assume they have double booked because of the way Mint displays transactions on the Transactions page. Mint does not handle cash expenses well with this in mind-it automatically categorizes entire ATM withdrawals as expenses in themselves, assuming you will be spending the cash somewhere down the road. Not how much cash you have to spend, but how much you do spend, when, and where, versus how much you make.

#Does quicken mint have expense accounts how to#

If you are one of these users, read on all will be made clear, and you will have a new understanding of your income, expenses, and how to use Mint like a champ.įirst, it’s important to know exactly what Mint is for: It is is primarily a tool for tracking spending and income within budgets.

#Does quicken mint have expense accounts software#

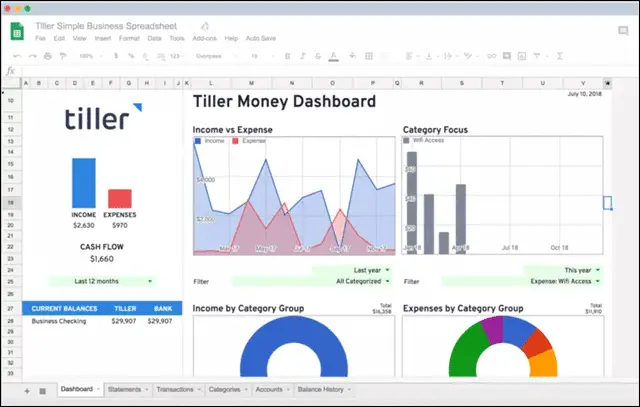

No longer does getting a hold of personal finances require spending hours and hours learning in-depth software like Quicken or creating tedious, error-prone spreadsheets on Excel does most of the work for us on our important assets and debts.īut many Mint users struggle with cash transactions, be they earnings or expenses. You can also see projected cash flow - how much cash you'll have available after you pay a certain ‘s patent-pending personal finance technology is a boon for those who want a 21st-century method of keeping track of their expenses quickly and easily. (You will have to enter manually the cost basis for securities or funds you purchased more than a year ago.) You can also export data into TurboTax and other tax programs to streamline tax preparation.Īnd unlike Mint, Quicken has a calendar, so you get a quick picture of when bills are due and when money is coming in. You can view your asset allocation, compare it with model portfolios and see how to rebalance to reach recommended allocations. It lets you track your portfolio's recent and historical performance and measure it against the market as a whole and relevant benchmarks.

#Does quicken mint have expense accounts free#

Quicken's Premier edition offers a robust investment section, a feature that is not available in free budgeting and money-management programs (nor in the less-expensive Basic and Deluxe versions of Quicken). Desktop-based software is also a good option for anyone nervous about storing financial information online. But if you want a more comprehensive view of your finances, including your investments, and you are willing to devote more time to the task, Quicken Premier can do the job. So why not save $65 and sign up for Mint or another of the growing number of free online budgeting sites (see Easy Ways to Track Your Cash)? They're fine for budgeting beginners, or if you just want budgeting lite.

0 kommentar(er)

0 kommentar(er)